Financial Stress. Sorted

Move from firefighting to structured prevention - with annual financial wellbeing programmes that reduce recurrence and protect retention.

Designed to strengthen existing provision and take pressure off HR teams.

Financial stress is often the least visible pressure inside workplace wellbeing strategies - and the most persistent.

Most organisations invest in support for burnout, anxiety and performance issues - yet find the same patterns returning.

Because one factor remains unaddressed:

Financial stress.

🟨 It affects employees at every level - regardless of job title

🟨 It influences focus, confidence and decision-making

🟨 It damages productivity, performance, retention and reputation.

This is not simply a financial issue.

It's a structural one.

When financial stress is addressed preventatively - rather than reactively - wellbeing initiatives work better, HR teams carry less burden, and recurrence reduces.

Ignore it, and it returns.

What a Structured Financial Wellbeing Year Looks Like

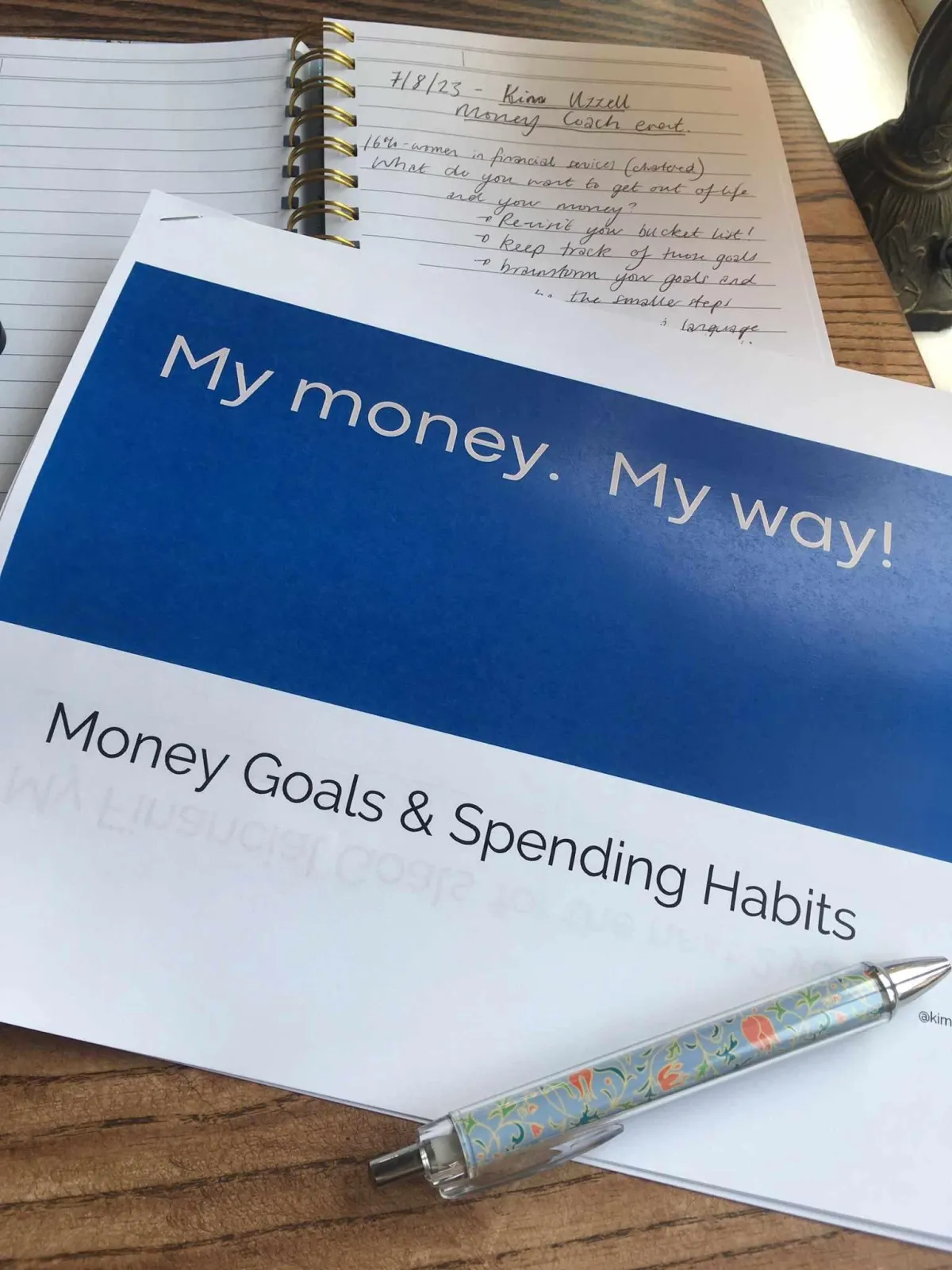

Each programme is built around strategically timed sessions, designed to reduce recurrence and address key organisational pressure points across the year.

Delivered online or in person, sessions can be aligned to onboarding, peak workload periods, life stages or organisational risk points.

The programme is structured across four core pillars that address both practical capability and underlying behavioural drivers.

Everyday Financial Confidence

Better Budgeting for All

Your Financial Health Matters

Money 101 for New Starters

Financial Patterns & Behaviour

Breaking the Debt Cycle

The Psychology of Spending

Money Mindset for High Earners

Life Stage and Risk Awareness

Money & The Menopause

Family Finances

Preparing for Retirement

Mental Health & Financial Stress

Men, Money & Mental Health

Financial Stress & Burnout Prevention

Money Anxiety & Decision Fatigue

Programmes are tailored to organisational risk profile, workforce demographics and strategic priorities.

The Silent Cost of Financial Stress - Real lives. Real Risks.

Almost 50% of UK employees say that money worries are affecting their performance at work.

70% of all employees under 55 report being anxious or stressed about money.

Over a THIRD have missed work as a result of their financial situation.

Around 23% are experiencing financial stress severe enough to have an impact on their mental health.

A THIRD of employees are living payday to payday.

In England alone, around 400,000 people consider taking their own life, every year, due to money worries.

Supporting employers under pressure

We know budgets are tight.

National Insurance hikes. Minimum wage increases. Pay review season. It all adds up. But supporting financial wellbeing isn’t just about pay rises.

It’s about giving employees the tools, education and confidence to make more of what they already have. We’re here to help your people manage their money better - not to encourage them to ask for more of it.

This isn’t a cost. It’s an investment in resilience, retention, and reputation.

Our Approach: Independent. Complementary. No Conflict.

Financial wellbeing isn’t just about earning more or sending people to debt helplines.

It’s about emotional safety, decision-making, and confidence.

We are here to:

Equip employees with tools to make confident financial choices

Enableeindividuals to face challenges without fear or shame

Foster resilience that impacts not just your people - but their families, teams, and your bottom line.

Independent. Strategic. Built to Integrate.

We are not:

❌ Financial advisors.

❌ Product pushers

❌ Replacements for your EAP or existing wellbeing provision.

We’re independent - and that’s our power.

It means we can work alongside your current partners to deliver deep, specialist support with no agenda. In fact, we help increase engagement with other services - maximising your overall ROI.

We don’t sit on the sidelines of your wellbeing strategy. We strengthen its foundations.

The Times and The Telegraph 5* Rated Financial Coaching.

Proudly featured in the Sunday Times Alternative Rich List 2025

Award winning and trusted by HR teams, wellbeing leads and forward thinking business leaders across the UK and beyond.

Copyright © 2026 The Financial Wellbeing Academy

All Rights Reserved.